how to buy ULIP, Invest in ULIP, Save tax with ULIP, Bajaj Allianz G

Test Case – Bajaj Allianz Goal

Assure, Step-by-step guide to invest in ULIP

Hi Friends, I have taken it up as

my resolution for this year to guide or help you with step by step process of various investment options. To name a few would be how to make fixed deposits, how to

buy life insurance, how to buy mutual funds etc. On this blog post, I would

like to focus on the emerging life insurance cum investment products, which in

recent times have gone through many upgrades, to promise superior return on investments

for long term (10 years and above).

ULIPs are not only a convenient

investment solution; they also offer tax benefits under 80c.

For a test case, I am choosing the newly launched BajajAllianz Goals Assure. Three reasons I have chosen this investment

solution:it’s the latest ULIP plan which boasts of minimum cost structure of

the policy, secondly the funds this ULIP invests in have proven track record

and last but the most important part, this plan focuses on your goal, which

gives many flexible options to switch investment within the plan, withdrawal

options, free-switches and flexible maturity benefits.

This ULIP Policy address an important need of goal based financial

planning. Often our financial plans are not aligned with the life goals,which

proves to be inadequate in the times of need. Hence, more and more financial

planners and experts are suggesting to move to goal-based planning to make the

maximum out of the investment and lead a stress free happy life. This policy comes handy as you will have to

sit once, read through, choose your preferences and relax.

About Bajaj Allianz Goals Assure – Find the brochure

A life goal based investment plan

(ULIP) that gives you the opportunity to plan once in a lifetime experiences

with one investment. It offers choice of eight funds which can be invested

through four investment strategies. The highlight of the plan is return of life

cover charge on policy maturity, tax free returns on your investment and life

cover. Investor also have an option of receiving the maturity benefit in

instalments and receive the benefit of Return Enhancer, which is an addition of

0.5% of each due instalment. Funds continue to be invested during this time.

Important features of Bajaj Allianz Life Goal Assure–

- Option to take maturity in installments

- Return Enhancer benefit

- Return of life cover charges at maturity

- Choice of 4 investment portfolio strategies to meet your financial goals

- Unlimited free switches between funds, choice of eight (8) funds to achieve your financial goals

- Tax benefits under section 80C

Step by Step process to invest in this PLAN – with some screenshots to

make your investment decision smooth.

To begin, Please Open

Step 1

Click Invest now.

Fill up the personal details like name, age, mobile, email and other

mandatory fields.

It also gives you an option to choose your life goal – buying a house,

child’s education, earn your first crore to name a few, you may also choose a

different option by choosing ‘others’ as an option.

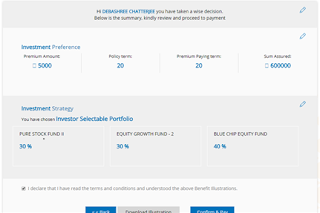

Step 3. Choose yearly premium

On filling up and submitting the details, you reach the next page which

asks about how much you wish to invest.

Step 4. Choose your plan

I chose planning for child’s higher

education hence to me the goal is 20 years away. I choose the payment term of

20 years and monthly premium of Rs. 5000. The payment term can vary between 15-

20 years basis your comfort, and the premium also can be chosen as per your

wish and goal. You have an option here namely ‘multiplier’ it gives you a

flexibility to choose the life cover on the premium you pay annually. In this

the minimum life cover you are assured is 10 times of your annual premium. You

can also increase it up to 20.

In the same page you will be given an option to choose your investment

style. You may consider wheel of Life or Trigger based portfolio if you want to

just enjoy the returns without much of involvement.

If you are a savvy investor, you have options of choosing your funds

actively. You will have range of funds to choose from, bonds to be the safest

ones but lowest on returns. Depending on your age, risk appetite you may choose this.

If you have a horizon below 10 years you may consider having an exposure to

bond funds, more no. of years you have on your side you may choose to have

higher exposure in equity. If you have invested in markets before and like the

long term growth story of equity markets, you may have higher allocation in the

Pure Stock fund II and Accelerator MidCap funds. If you see the window, you can

choose multiple funds upto 6 funds. However, personally I want to have a

complete equity exposure in 3 of its funds in equal proportion as I have 20

long years in hand, and I have an option to switch freely later.

how to buy ULIP, Invest in ULIP, Save tax with ULIP, Bajaj Allianz G

Step 5. Verify details

You check and verify the details you filled up so far.

Step 6.

Enter the payment mode

how to buy ULIP, Invest in ULIP, Save tax with ULIP, Bajaj Allianz G

Step 7.

Make the payment with Net banking or credit card or online wallet.

Documents required

1.

Your

PAN Card

2.

Adhaar

Card

3.

Demat

account (Optional)

4.

Address

proof

5.

Bank

account details

This is a simple process to invest in ULIP which is

emerging as one of the best option for long term investment like buying house,

child’s education, earning your first crore or funding your start-up. etc.

The

website also features and Return calculator to help you get a sense of return

you may get in your investments. Though the illustration shows a

return on 4% and 8%, in real term with equity funds, the returns can go above

10% easily over 15-20% making it a substantial gain in compared to the

traditional saving products.

I will come back to you with

similar investment step-by-step guide for other investment products. Keep

saving, Keep investing and do spend on yourself.

Live a stress free life with goal

based investing.

how to buy ULIP, Invest in ULIP, Save tax with ULIP, Bajaj Allianz Goal Assure

No comments:

Post a Comment