- GOLD ETF thrives on high liquidity, can be converted into physical on 1 kg of gold, NRIs can invest too

- SGB offers interest on investment and capital gain tax exempted on redemption

Gold has been one of the oldest currency/ investment

instrument world-wide. It is used widely as currency hedge, hedge against #inflation, and safe heven during various economic or political crisis. In India #Gold has a very special place. It is a popular investment choice among Indian

households. However, the mode of investment is Jewellery and it is an emotional

choice on rather than a well thought out investment choice, it is mostly bought

as a wedding gift for the bride as “Stri

Dhan” as it is referred.

There are many theories on the ideal exposure on this asset

class, but no-one can deny that a portion of wealth should be kept in Gold, may

vary from 10-20% of total portfolio, as its price tends to increase with the

rise in the cost of living.

Jewellery,

coins and bars – Asset with emotions attached

Though the asset class is important, investing in this has been a

high-cost and difficult one. In Jewellery and gold bars, there many concerns

like safety and storage, purity concerns and difficulty in trading. It also

attract high taxation. It comes at a premium adding making charges in the range

of 8 -25%, it my further vary depending on the seller.

GOLD ETF –

Buy any day/ sell any day/ keep as long as you want

Last decade has seen a gradual but major shift in investors’ taste,

with Mutual Fund companies offering GOLD ETFs and Gold FoF (Fund of Funds). GOLD

ETFs are nothing but open-ended funds that trade on a stock exchange just like

equity shares. Gold ETFs can be bought anytime like equity shares, can be

bought anytime with minimum investment of 1 unit. Gold FOFs are predominantly used

for SIP facility (monthly recurring investment) investing in Gold ETFs to

accumulate Gold over a period of time. This is stored in dematerialised format,

so no fear of theft or storage concerns. Though it comes under long term/short

term taxation depending on the investment horizon, it doesn’t have any wealth

tax attached. This is the most liquid form of Gold investment.

NRIs can

Invest in Gold ETF through trough exchanges with registered PINS account.

Gold

Sovereign Bonds – Only form which pays interest

There is a new entrant in the market for investing in Gold, Sovereign

Gold Bonds. Introduced in H2, 2015, bonds are issued by RBI in tranches on

behalf of Government of India.

Sovereign Gold Bond Scheme, is an alternative instrument for

holding Gold. Investors can simply apply through designated Banks/ PO/ NBFC and

NSE brokers for investing in the SGB scheme in Paper/ Demat format. n a paper

form through Sovereign Gold Bond Scheme. The under-lying asset for these bonds

is Gold. These bonds will track the price of gold. The bonds also offer 2.75%

interest income on the initial investment amount paid semi-annually to the

investors. Minimum investment amount is equivalent to 1 gm of physical gold.

The

minimum tenor of the bonds are 8 years however, there is exit options in 5th, 6th and 7th

year and it has a fixed tenor. The bonds are tradable in stock exchanges for those who holds the bonds

in demat format. It doesn’t attract any capital gain taxes on redemption,

however, interest pay out and early exit attract taxes as per long term/ short

term gains.

Though the investment format is good, liquidity is low with exit

option after 5 years with fixed tenor for maturity and the liquidity on

exchange transaction remains to be seen.

So far in One year, Government of India has mobilised investment

worth 2,292 crore Rs in four tranches in series I. Data shows no. of applications

for the fourth tranche increased to 1.95 lakh from 62,169 in the first tranche.

Despite these advantages, investors must note that liquidity in secondary

market for sovereign gold bonds is yet to be seen.

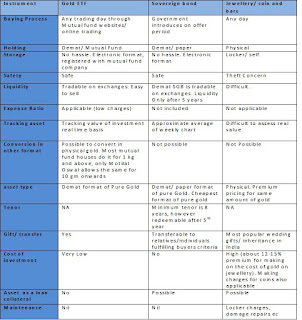

The table intends to illustrate various

aspects on the investment instruments.

No comments:

Post a Comment